Reflections on week 1 of #milemadness

/As I've mentioned, this month I'm participating in a good-natured (but cut-throat) competition with a gaggle of other miles and points bloggers to see who can generate the most value at the lowest cost during the month of March. On March 1, we started with a $5,000 "bankroll" which we can use to fund any manufactured spending technique we want — on the condition that we can't use the money again until we've liquidated whatever product we purchased.

Frequent Miler, the competition's judge, has published the first week's results, so it's time for some serious reflection on my strategy (or lack thereof) so far.

My Score

As you can see, I'm in third-from-last place, earning just $250 in net "Fair Trading Value" using Frequent Miler's calculations on the cost of acquiring various mile and point currencies, after deducting the fees I incurred. But I can explain!

My Raw Data

Between March 1 and March 7, I manufactured $19,861 within the limits of my bankroll. That's the spend that I was allowed to count each day taking into account the amount of manufactured spend I had already liquidated.

That comes out to $2,837 in manufactured spend per day, on average, and that sum is in fact fairly competitive with the other players' average data.

Office Max Ruins Everything

The main reason I fell so far behind so quickly is that while I was earning 2-4% cash back in value, my competitors with Chase Ink credit cards were purchasing PIN-enabled Visa gift cards at Office Max for below face value.

That enabled them to quickly increase their bankrolls above the $5,000 limit: if they charged $4750, but liquidate $5,000, they're suddenly working with a bankroll of $5,250. That's an advantage that quickly added up for many.

Even worse, they were earning super-valuable Ultimate Rewards points, which brings me to...

The Curse of Fair Trading Prices

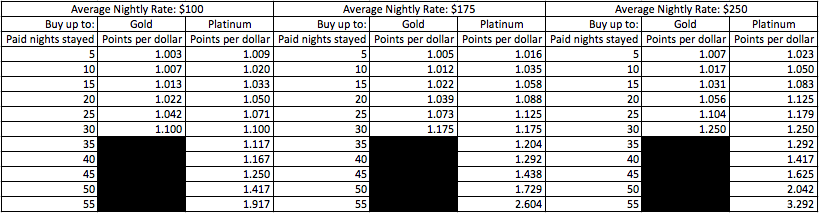

The tool we're using to judge this competition is Frequent Miler's proprietary system of "Fair Trading Prices," which you should read about here and here, if you're not already familiar with the concept.

The key thing to keep in mind about Fair Trading Prices is that they are not based on redemption value. Let me repeat that: Fair Trading Prices are not an attempt to assess the actual value of the points and miles we earn during the competition.

For example, I recently argued that under a variety of fairly realistic conditions, Club Carlson Gold Points can be worth 1 cent each, for example if you plan to spend exactly 2 nights in New York City and would otherwise spend $111 or more per night on a hotel room.

The Fair Trading Price of Club Carlson points is just 0.25 cents each.

So while I earned 18,710 Gold Points during the competition, which I value at around $187, I received just $47 in credit based on the Fair Trading Price.

Meanwhile, since the Fair Trading Price of Chase Ultimate Rewards points is 1.38 cents each, the 5 points per dollar my competitors were earning worked out to a 6.9% earning rate in Fair Trading Value!

My Strategy

Ultimately, while the competition is a great motivation to step up my game and see just how much I can manufacture when I really put my mind to it, it's not enough to convince me to change my overall strategy in order to game the Fair Trading Prices.

The fact is, I have a lot of irons in the fire:

- Meeting American Express Delta Platinum $50,000 spending threshold to earn 1.4 Skymiles per dollar;

- Meeting $20,000 Chase British Airways minimum spending requirement for 100,000 Avios;

- Earning just 1% cash back on my first $6,500 in purchases on my American Express Blue Cash card, with its woefully low credit limit;

- Meeting $3,000 minimum spending requirement on American Express Hilton HHonors Surpass for the 50,000 HHonors upgrade bonus.

While that last item isn't a large spending requirement, I am attempting to meet it at merchants that offer 6 HHonors points per dollar, which is a huge time-suck for me since my local gas station has been sold out of PayPal My Cash cards for weeks.

Conclusion

The competition goes on! For more real-time information on the state of play, you can follow me on Twitter or search for the hashtag #milemadness.