Now that I've had a few days to think about the pre-launch of the Amex Everyday and Everyday Preferred cards, I have a slightly-less-preliminary take than my Twitter post late Saturday night.

While the cards are being marketed as the entry-level and premium versions of the same product line, that's irrelevant to us. American Express is launching two new cards, with different annual fees and different earning structures; consequently, the two cards will be right for different people, and I'll analyze each compared to its most relevant competitors.

No annual fee: Amex Everyday vs. 1–5% cash back

As I've said before, if you aren't a business traveler who's reimbursed for your credit card expenses, and you don't aggressively manufacture spend, you should carry a Fidelity Investment Rewards American Express ($75 signup bonus), which earns 2% cash back on all purchases, and another Visa, MasterCard, or Discover card to use at merchants that don't accept American Express. For example, the Discover it ($150 signup bonus) doesn't charge foreign transaction fees and has rotating 5% cash back categories, while the Chase Freedom ($100 signup bonus) has rotating 5% cash back categories and allows you to redeem 20,000 points for a paid airline ticket costing up to $335 (you can charge any amount over that to the card itself).

The Amex Everyday card is competing against these existing, no-annual-fee, options. The card earns:

- 1 flexible Membership Rewards point per dollar, which can be transferred to airline and hotel partners or redeemed for flights, hotels, and cruises through the Membership Rewards portal at 1 cent per point;

- 2 Membership Rewards points per dollar spent at grocery stores, on up to $6,000 in spend annually;

- and a 20% bonus on all points earned each month that you charge 20 or more transactions to the card.

First of all, I want to say that this is not a terrible earning structure, and when the card is launched April 2, it will be the only no-annual-fee card I know of that offers flexible points. Assuming you're able to make 20 transactions per month, earning 1.2 flexible Membership Rewards points per dollar means you'd need to value a Membership Rewards point at 1.68 cents in order to break even compared to putting the same (non-bonused) spend on a 2% cash back card. That's a high value, but it's not insane: Membership Rewards points can be transferred at a 1:1 ratio to British Airways Avios, and if you live in a destination served by Alaska Airlines or American Airlines it's relatively easy to get 2-3 cents per point from Avios on expensive, short-haul flights.

Second of all, if you are inclined to manufacture spend at grocery stores, then being able to mint 14,400 Membership Rewards points per year (after the 20% bonus) is a great addition to your fee-free credit card portfolio; in other words, this one card can, with no annual fee, serve roughly the same purpose as both a Chase Freedom and $95-annual-fee Chase Sapphire Preferred or premium Ink card, which together allow you to generate 7,500 Ultimate Rewards points per quarter that can then be transferred to the flexible Sapphire Preferred or Ink Ultimate Rewards account.

$95 Annual Fee: Amex Everyday Preferred vs. Chase Ink

A more pressing question for some of my readers is no doubt whether the Amex Everyday Preferred's $95 annual fee is worth paying, and if so, whether the card should join or replace a $95-annual-fee Chase Ink card.

The Amex Everyday Preferred card earns:

- 1 flexible Membership Rewards point per dollar;

- 3 Membership Rewards points per dollar spent at grocery stores (up to $6,000 per year);

- 2 Membership Rewards points per dollar spent at gas stations, with no annual limit;

- and a 50% bonus on all points earned each month that you charge 30 or more purchases to the card.

That means that rather than just 14,400 Membership Rewards points, if you were inclined to manufacture spend at grocery stores you could earn 27,000 points per year. However, you'd pay $95 for the additional points, or about 0.75 cents each versus the no-annual-fee card. That's a perfectly reasonable price to pay, but it's not free.

The competition really heats up at gas stations, where after the 50% bonus the Everyday Preferred card earns 3 Membership Rewards points per dollar, compared to the Ink's 2 Ultimate Rewards points per dollar. That's a real difference, and while Membership Rewards points don't transfer to United or Hyatt (as Ultimate Rewards do), they do transfer at a 1:1.5 ratio to Hilton, a 3:1 ratio to Starwood, and a 1:1 ratio to many airlines, including oneworld's British Airways, Sky Team's Delta, and United's Star Alliance partner All Nippon Airlines.

The Perils of Orphaned Points

Those are the facts, and I think I've given these cards as fair an assessment as they're likely to get. Now let's talk about the Amex-sized elephant in the room: what the hell are you going to do with these Membership Rewards points?

I ask because if you don't have a specific redemption in mind, your points are only going to lose value the longer they sit in your Membership Rewards account. Say you pick up an Amex Everyday card and over the course of a few months put $6,000 in grocery store charges on the card. Say you do that every year for 4 years. Together with the other monthly purchases that get you up to 20 transactions, you've managed to earn 60,000 Membership Rewards points, which you can then transfer to Delta and, if you try hard enough, maybe book a low-level Economy award to Europe.

However, it took you 4 years. Delta devalues its award chart every 3 months.

The same $24,000 in spend could have earned you $480 with a 2% cash back card. Is $480 going to get you a round-trip ticket to Europe? No, probably not. But it'll get you most of the way there, on the flights and days you want, without having to muck around with award availability, Membership Rewards transfer times, and of course award chart devaluations.

All of this is to say, know the program and have a plan before you sign up. If you don't have a plan, save yourself the trouble and enjoy the beauty of the cash(back) economy.

Is Amex cannibalizing its other product lines?

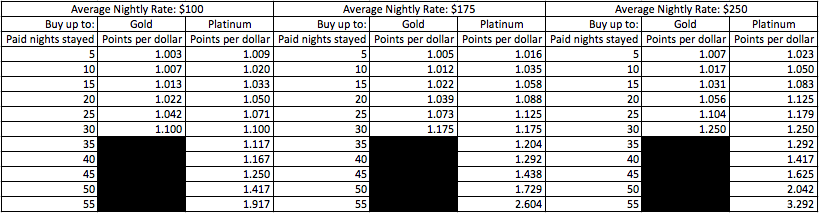

Finally, this is something I keep pondering: why is Amex introducing one card that replicates features of so many of its other product lines? Here's a rough chart I threw together, comparing the Amex Everyday and Everyday Preferred cards with two other product lines I happen to carry: