A travel hacker who applies for 2-4 new credit cards every 3-6 months soon ends up having to decide whether their rewards-earning credit card is worth keeping after the first year. Today I want to take a look at a variety of factors to take into consideration when deciding whether to keep a card once the annual fee comes due.

Every rewards card should be compared first and foremost to the no-annual-fee, flat 2% cash back Fidelity Investment Rewards American Express: no card is worth paying an annual fee for if you don't think you'll make back enough value to pass up 2% cash back.

1. Low/no annual fee

This may go without saying, but if a credit card doesn't have an annual fee, or has a sufficiently low annual fee, it can be worth keeping in order to lengthen the average age of your credit accounts, which is one of the factors that determines your credit score. The obvious examples are the Chase Freedom, Discover It, Citi Dividend Platinum Select, and US Bank Cash+ (apply in-branch only), all of which have no annual fee and feature rotating quarterly 5% cash back categories.

A slightly more interesting case is that of low-annual-fee cards, like the US Bank Flexperks Travel Rewards Visa Signature card, which has a $49 annual fee. If you aggressively take advantage of this card's bonus categories (2x on whichever of gas, groceries, or airfare you spend most on each month; 2x on cell phone expenses; 3x on charitable contributions), then you can earn back the $49 annual fee after just $1166-$1750 in purchases or charitable contributions, since you can redeem 3500 FlexPoints to pay your annual fee.

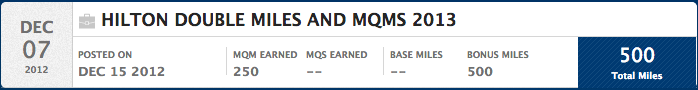

Other cards in this category include the no-annual fee American Express and Citibank Hilton HHonors co-branded credit cards. There's no reason not to keep the cards and put an occasional purchase on them in order to help age your credit report, and earn Hilton points if you happen to be short for an upcoming redemption.

That brings us to the second case where a card might be worth keeping after the first cardmember year:

. Bonus categories

There are common purchase categories, like groceries, gas, and restaurants, where you may spend enough money each year to make up for the annual fee on a card which bonuses those categories.

he Chase Sapphire Preferred Visa and Mastercard offer double flexible Ultimate Rewards points on restaurant and travel spending (but not gasoline!), and come with a $95 annual fee. If you value Ultimate Rewards points at a conservative 1.5 cents each, then you'll need to spend $9,500 in bonused categories each year in order to make back the $95 annual fee and the 2% cash back you've foregone. Why? Because the first $3,167 you spend in bonus categories will earn you 6,333 Ultimate Rewards points, which you value at $95, enough the cover the annual fee. However, to break even, you also need to make back the $63.34 you would have earned using a no-annual-fee 2% cash back card, which will take you another $6,334 in bonused spending (since you're earning one "extra" cent in value per dollar of bonused spending). In other words, $9,500 in bonused spending is worth $285, minus a $95 annual fee, while $9,500 spent on a flat 2% cash back card is worth $190.

If you value flexible Ultimate Rewards points at a more realistic 2 cents each (for example, for redemptions with United Airlines and Hyatt), then you'll need just $2,375 in bonused spending to make back the annual fee, and then another $2,375 in order to break even (since in this case you're earning 2 "extra" cents per dollar of bonused spending). Everything you spend in bonus categories after that $4,750 is pure profit.

3. Annual benefits

Some cards are worth keeping for benefits you receive either every calendar year or every year when you pay your annual fee:

- merican Express Delta Platinum ($150 annual fee) and Reserve ($450). These premium Delta co-branded cards offer a free annual companion ticket, good for domestic travel, economy in the case of the Platinum card and first class in the case of the Reserve card. Although there are some limitations on the fare classes you can redeem these tickets for, this is still an easy way to make back most or all of your annual fee: you buy one ticket, and you get to bring a companion along, paying only nominal taxes and fees on the second ticket.

- Additionally, the American Express Delta Reserve card includes a Delta Skyclub membership: if you pay for a Skyclub membership each year (for example, if you aren't a Delta Diamond Medallion), you're strictly better off paying the Reserve card's annual fee and getting a free companion ticket as well.

US Bank's Club Carlson ewards ($50 annual fee), Premier Rewards ($75) and Business ($60). The Rewards card offers a 25,000 Club Carlson point bonus each year, while the Premier Rewards and Business cards offer 40,000 bonus points per year. Since these cards also give you the last night free on all award redemptions of 2 or more nights, keeping these cards after the first year is a no-brainer: cardholders can redeem 50,000 points for two(!) award nights at any Club Carlson property in the world.

4. Bonuses for high yearly spending

Annual spending bonuses are one of the trickiest areas to evaluate objectively. The following cards offer annual spending bonuses which may make an annual fee worth paying:

- American Express Delta Platinum. 10,000 redeemable miles and 10,000 MQM after each of $25,000 and $50,000 are spent on the card each year.

- American Express Delta Reserve. 15,000 redeemable and 15,000 MQM after each of $30,000 and $60,000 are spent on the card each year.

- Chase United MileagePlus Explorer (although check here to see if you qualify for a better offer). 10,000 redeemable miles after $25,000 in spending on the card each year.

or each of these cards, the annual fee is more than made up for by the bonus miles scored at each card's annual spending threshold, as long as you have a high-value redemption planned for those miles.

5. Cards that aren't worth keeping

Above I've outlined some suggestions for when a card is worth keeping. Now we can take a look at a few cards whose rewards are just not rewarding enough to justify the annual fee.

- American Express Premier Rewards Gold ($175 annual fee). While this card occasionally has signup bonuses that are high enough to justify applying for the card, it doesn't provide enough value added in any of the above categories to justify paying the annual fee. First, the annual fee is twice that of comparable cards (Chase Sapphire Preferred). Second, while the card earns triple flexible Membership Rewards points on airfare purchases, the Sapphire Preferred can ALSO earn up to 4x flexible Ultimate Rewards points on airfare, while saving you $80 per year (see an upcoming post here on the blog). Third, the card has no annual benefits that make it worth keeping year after year. And finally, while the 15,000 bonus Membership Rewards points are certainly worth earning the first year you have the card, they barely cover the value of the annual fee. No matter how highly you value Membership Rewards points, it's just too difficult to squeeze value out of the annual fee, year after year.

Conclusion

I hope this brief discussion clarifies some of the issues involved in deciding whether to keep a card once its annual membership fee is due. The most important thing to remember is that the goal of this game is not to break even; it's to win.